From the Independent....

Consumption of sugar from soft drinks fell in the year after sugar tax brought in

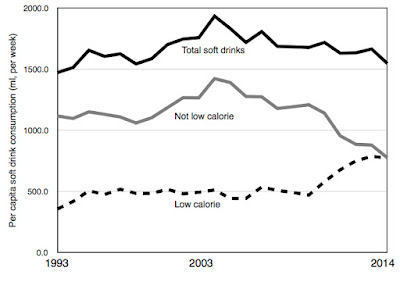

Consumption of sugar in soft drinks was falling long before anyone took the idea of a sugar tax seriously, as I pointed out in 2016.

However, the headline is not quite a statement of the obvious. It refers to a new study in the BMJ which looks at soft drink consumption between 2014 and 2019. It is part of the official evaluation which, in classic 'public health' fashion, is being conducted by academics who spent years cheer-leading for the policy. And it's costing the taxpayer £1.5 million.

The study's conclusion is - obviously - that the sugar tax was a success. The authors report no change in the number of drinks sold, but claim there was a 9.8% fall in sugar consumed in soft drinks after the tax was implemented. That's 29.5 grams a week per household.

Reasonably enough, the authors attribute this to manufacturers reducing the sugar content. They even try to reach out to the 'food [sic] industry' in the text.

... the overall reduction in sugar with no change in volume we report here might represent a valuable benefit for public health with little harm to the food industry.

As artificial sweeteners are cheaper than sugar, that may be true. However, the data only go up to March 2019 and it's worth remembering that the summer of 2018 was unusually hot and therefore saw more drink sales than normal (a fact that has been mentioned in connection to minimum alcohol pricing which also began in spring 2018).

The SDIL [Soft Drinks Industry Levy] has also been found to have had no long term negative effects on the share value or turnover of UK soft drinks companies, suggesting that, contrary to industry predictions, public health can gain without negatively affecting the soft drinks sector.

Firstly, tell that to AG Barr whose share price has never recovered from its poorly received reformulation of Irn-Bru.

Secondly, there hasn't really been any 'public health gain', has there? Obesity rates haven't declined and it is not clear whether calorie intake has declined either. Sugar consumption has been gradually falling for decades and yet people keep getting fatter. All the sugar tax did was ruin some erstwhile delicious drinks.

It's not even clear that the sugar tax had the effect that the authors are claiming. They compare the real world evidence with a counter-factual, which always has the potential for mischief but was inevitable given the strong downward trends in sugar consumption prior to the tax being introduced.

The study divides the timespan into three periods: 2014-16 (pre-announcement), 2016-18 (post-announcement) and 2018-19 (post implementation). Table 1 shows the volume of drinks and amount of sugar consumed in each phase.

Sales of high-sugar drinks were clearly falling before the sugar tax was announced, let alone implemented. Did the rate of decline increase after the tax was implemented? At a push, you can just about see a small step-change.

But if you combine all the drinks (high, medium, low and zero sugar), you'll see that the average household was consuming 141.5g of sugar from them in the 2014-16, 109.5g in 2016-18 and 80.1g in 2018-19. In other words, there was a bigger decline (32g) between the two periods before the tax was implemented than between the post-announcement and post-implementation period (29.4g).

Curiously, the data behind the figure that has driven the headlines today - the 10% drop in sugar consumption - doesn't appear in the main text, but is tucked away in the supplementary material. It is quite underwhelming. At the risk of being accused of 'eye-balling' the data, there doesn't seem to be much going on here. As so often in these studies, it all depends on how much you trust the counterfactual.

It wouldn't be surprising if the sugar tax led to some reduction in the amount of sugar consumed in soft drinks, especially since several companies felt inspired to take the sugar out of their flagship brands. But in the decade leading up to 2014, the amount of sugar consumed in soft drinks had already dropped by 45% and it would drop further before George Osborne announced the sugar tax (as this study shows).

Was it really worth all the fuss? The secular trend is far stronger than anything that can be attributed to the sugar levy. Call it fashion, education or persuasion, but people had greatly reduced their consumption of sugary drinks long before the 'public health' lobby barged in with their regressive tax. Previous reductions in sugary drink - and indeed sugar - consumption have not been accompanied by a decline in obesity rates and that seems unlikely to change regardless of whatever marginal effect the 'public health' lobby tries to take the credit for since 2018.

1 comment:

Are you saying that the trend was downward before the government took action, and that the harm caused wasn't worth the government action? That people made their own decisions without government coercion? It sounds very plausible to me but, funny, I'm sure I've heard that argument before somewhere.

Post a Comment