The Conservative Party conference begins today and the IEA will be hosting two days of solid debate in the Think Tent, kicking off at 8am with a panel discussion on medical cannabis which I will be chairing.

I'll be speaking straight after, at 9am, about the nanny state with Ben Bradley, Vicky Ford and Tim Stanley (chaired by Darren Grimes).

I'll also be in the Think Tent on Tuesday at 10.15am talking about recreational cannabis, and I'll be with the Conservative Environmental Network on Monday at 5.30pm talking about environmental policy. That's in Room 3/4 of the secure zone.

See the full schedule of events here. The Adam Smith Institute (ASI) also has some interesting looking events - see their line up here.

All of that is in the secure zone, I'm afraid, so if you haven't got a pass you won't be able to attend. The ASI and Freedom Association have often held events outside the secure zone in the past, but not this time, alas. However, if you're in Manchester and want to go to something political, or if you're at the conference and want to get out of the secure zone, Starkey on Brexit has taken my eye and Comedy Unleashed will be on Monday night. There is a full list of fringe events here.

Sunday, 29 September 2019

77% of people suffering from THC-related lung injuries admit to using THC

I've followed up my Spectator article about the US vape scare from a weeks ago with an article in the Telegraph. Since writing it, the Centers for Disease Control have said that 77 per cent of the cases admitted to having used THC vapes. If a bunch of

people at a festival got ill with a particular disease and 77 per cent

of them admitted to taking the same drug, we would have no trouble

working out the other 23 per cent had also taken it.

As I say in the article...

The article is paywalled but read it here if you have access.

As I say in the article...

Case closed. Or so you might think. The CDC accepts that most of the individuals involved admitted to vaping THC before becoming ill, but refuses to exonerate conventional, legal, nicotine vaping on the basis that some of them did not.

This leaves two possible explanations. The first is that there is something terribly dangerous about conventional e-cigarettes that cannot be explained by science. Despite being used safely around the world for over a decade by tens of millions of people, it turns out that they can severely incapacitate and even kill otherwise healthy people almost overnight. These dangers have only emerged in certain parts of the USA in recent weeks and just happened to coincide with a spate of hospitalisations involving exactly the same symptoms that were caused by people vaping illegal THC cartridges.

The second possibility is that the handful of people who have been hospitalised with ‘vaping-related’ lung injuries but who deny vaping illegal THC are not telling the truth, presumably because they do not wish to confess to a crime. Almost unbelievably, a large section of public and political opinion in the USA leans towards the first of these scenarios. A genuine public health problem caused by the black market is being portrayed as a problem of the legal market.

The solution? Turn the majority of the e-cigarette industry over to the black market. It takes wilful ignorance to draw such a conclusion.

The article is paywalled but read it here if you have access.

Thursday, 26 September 2019

An alternative history of minimum pricing

In April, I wrote of minimum pricing...

Sheffield and Stirling have yet to report back, but today saw the first attempt to rewrite history. Peter Anderson and friends have published a study in the BMJ claiming that alcohol sales fell by 7.6 per cent in the off trade in the first eight months of minimum pricing.

This is a lie, but if you torture the data enough you can make it confess to anything. Instead of looking at the alcohol sales figures in Scotland, they took a sample of 5,000 Scottish households and made numerous adjustments to the figures based on an unspecified counterfactual.

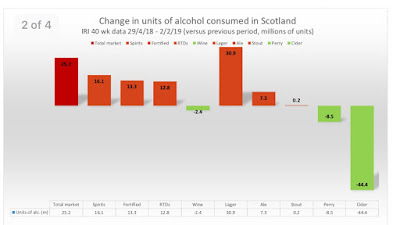

The number of units of alcohol sold in the off trade in the first nine months of minimum pricing actually rose, as the IRI figures below show. We also know that the number of alcohol-related deaths rose in 2018. These are the hard facts and they are in the process of being deleted. As was inevitable, an alternate history is being constructed in which minimum pricing had a dramatic effect on both alcohol sales and alcohol-related deaths. The media fell for it last week, they fell for it today and they will fall for it again in the near future.

The studies might as well have been written before the policy was implemented. Unable to show an actual decline in consumption, the evaluators at Sheffield and Stirling Universities (for it is they) will have to resort to using a back-of-the-envelope counterfactual which will doubtless conclude that consumption is lower than it would have been in the absence of minimum pricing.

This will then be presented to the media as a decline and the policy will be declared as a success, albeit with the caveat that the unit price should be raised to 60p.

Sheffield and Stirling have yet to report back, but today saw the first attempt to rewrite history. Peter Anderson and friends have published a study in the BMJ claiming that alcohol sales fell by 7.6 per cent in the off trade in the first eight months of minimum pricing.

This is a lie, but if you torture the data enough you can make it confess to anything. Instead of looking at the alcohol sales figures in Scotland, they took a sample of 5,000 Scottish households and made numerous adjustments to the figures based on an unspecified counterfactual.

The number of units of alcohol sold in the off trade in the first nine months of minimum pricing actually rose, as the IRI figures below show. We also know that the number of alcohol-related deaths rose in 2018. These are the hard facts and they are in the process of being deleted. As was inevitable, an alternate history is being constructed in which minimum pricing had a dramatic effect on both alcohol sales and alcohol-related deaths. The media fell for it last week, they fell for it today and they will fall for it again in the near future.

Tuesday, 24 September 2019

'Public health' launches a preemptive strike on Ofcom

UPDATE: Ofcom’s former Principal Economist has been in touch with his own rebuttal to the study discussed below. Read his response here.

On the face of it, this is a pretty odd thing to see published in BMJ Open. Three 'public health' academics looked at every response to a 2006 public consultation on food advertising restrictions, which ultimately led to the UK government banning adverts for 'junk food' (high in fat, sugar or salt or HFSS) during children's television.

The consultation was run by Ofcom, the broadcast regulator. The authors divide the respondents into 'pro-industry and pro-public health groups' (because that is how the world looks from their perspective) and conclude:

Isn't that the point of a consultation?

The authors focus on five key questions in the consultation and look at the responses from the two groups.

Should restrictions apply to all foods?

Both groups agreed that the restrictions should not apply to all food.

Total ban or volume based ban?

A volume based ban was 'nearly universally disliked'.

Restrictions on children’s programming or a pre-9pm watershed ban?

The authors note that: 'Although not included in any of Ofcom’s proposals, one of the consultation questions asked about whether restricting advertising before 9pm would be a suitable measure.' Unsurprisingly, the 'public health' groups leapt at the chance to extend the ban while the 'pro-industry' groups opposed it.

To what ages of children should the restrictions apply?

Ofcom's original proposal was to restrict advertisements targeted at children aged 4–9 years. 'Pro-industry groups' supported this. 'Public health' groups called for the ban to apply to children aged 4-15 years.

When should the restrictions start, ie. how long should the transition period be?

'Public health' groups, being the business experts that they are, said no transition period was necessary. 'Pro-industry groups' said that they needed a transition period.

In line with what both groups supported, the final legislation did not apply to all food and was not volume based. In line with what the 'public health' groups wanted, the age range was extended to 4-15 years. In line with what the 'pro-industry' groups wanted, there was a transition period and the ban was not extended to the 9pm watershed - although the latter was, to repeat, never part of the original proposal.

What does this tell us? According to the authors, it tells us that...

This is true and therefore intolerable from their perspective. They go on...

Really?! Ofcom stuck to its original proposal and capitulated to the 'public health' lobby on the age range. It seems that anything less than total capitulation to the most extreme nanny state voices plus gold-plating would have 'compromised' the legislation in these people's eyes.

They further complain that...

And that, apparently, is a bad thing.

What is the purpose of this bizarre study raking over a 13 year old consultation? There seems to be no reason for it to exist.

Until you remember that the government has recently consulted on extending the ban on food advertising, and the 'public health' lobby is trying to sideline and intimidate Ofcom. Hence the way this study was press released and reported...

Nothing happens in the world of 'public health' research without a reason. Everything is political.

On the face of it, this is a pretty odd thing to see published in BMJ Open. Three 'public health' academics looked at every response to a 2006 public consultation on food advertising restrictions, which ultimately led to the UK government banning adverts for 'junk food' (high in fat, sugar or salt or HFSS) during children's television.

The consultation was run by Ofcom, the broadcast regulator. The authors divide the respondents into 'pro-industry and pro-public health groups' (because that is how the world looks from their perspective) and conclude:

Our paper highlights how, despite the relative transparency of the 2006–2007 consultation, the final policy appeared to be substantially influenced by stakeholders.

Isn't that the point of a consultation?

The authors focus on five key questions in the consultation and look at the responses from the two groups.

Should restrictions apply to all foods?

Both groups agreed that the restrictions should not apply to all food.

Total ban or volume based ban?

A volume based ban was 'nearly universally disliked'.

Restrictions on children’s programming or a pre-9pm watershed ban?

The authors note that: 'Although not included in any of Ofcom’s proposals, one of the consultation questions asked about whether restricting advertising before 9pm would be a suitable measure.' Unsurprisingly, the 'public health' groups leapt at the chance to extend the ban while the 'pro-industry' groups opposed it.

To what ages of children should the restrictions apply?

Ofcom's original proposal was to restrict advertisements targeted at children aged 4–9 years. 'Pro-industry groups' supported this. 'Public health' groups called for the ban to apply to children aged 4-15 years.

When should the restrictions start, ie. how long should the transition period be?

'Public health' groups, being the business experts that they are, said no transition period was necessary. 'Pro-industry groups' said that they needed a transition period.

In line with what both groups supported, the final legislation did not apply to all food and was not volume based. In line with what the 'public health' groups wanted, the age range was extended to 4-15 years. In line with what the 'pro-industry' groups wanted, there was a transition period and the ban was not extended to the 9pm watershed - although the latter was, to repeat, never part of the original proposal.

What does this tell us? According to the authors, it tells us that...

Ofcom’s decision to implement modified package 1 contained concessions to commercial as well as civil society and public health stakeholders.

This is true and therefore intolerable from their perspective. They go on...

However, ultimately, industry arguments appeared to hold more sway, with the main concession to public health groups being expanding restrictions from children aged 4–9 years to those aged 4 –15 years. Ofcom appeared to believe that the commercial impact of the regulation of advertising should carry greatest weight, even when the aim of the regulation was to protect children’s health. As such, Ofcom did not formally consider a pre-9pm ban as part of any of its packages, as had been proposed by public health and civil society stakeholders, although one of the consultation questions did refer to a pre-9pm ban.

Really?! Ofcom stuck to its original proposal and capitulated to the 'public health' lobby on the age range. It seems that anything less than total capitulation to the most extreme nanny state voices plus gold-plating would have 'compromised' the legislation in these people's eyes.

They further complain that...

Ofcom appeared to balance arguments related to commercial and public interests, in terms of jobs and the wider economy, with those relating to public health.

And that, apparently, is a bad thing.

What is the purpose of this bizarre study raking over a 13 year old consultation? There seems to be no reason for it to exist.

Until you remember that the government has recently consulted on extending the ban on food advertising, and the 'public health' lobby is trying to sideline and intimidate Ofcom. Hence the way this study was press released and reported...

Doctors slam broadcasting regulator Ofcom for 'being influenced' by the junk food industry after it turned down a 9pm watershed for adverts in 2009

Doctors say media watchdog Ofcom should no longer be allowed to set rules on junk food adverts.They claim the watchdog is influenced by broadcasters and the food industry, and this may have prevented a 9pm 'watershed' for junk food ads being brought in to protect children.Doctors working in public health looked at the last major regulations on advertising unhealthy food to children, introduced in 2009.They say Ofcom appeared to prioritise commercial considerations over children's health, begging the question of whether its 'duty to protect broadcasting interests' should allow it to lead public health regulation.

Nothing happens in the world of 'public health' research without a reason. Everything is political.

Monday, 23 September 2019

The sugar reduction flop

Public Health England published its second progress report on the sugar reduction scheme on Friday. The agency's press release focused on the amount of sugar taken out of soft drinks, which was understandable given that the 'progress' with food was almost nonexistent.

The plan was for there to be a five per cent reduction across the targeted foods (ie. most food) by 2017 and a 20 per cent reduction by 2020. I have always maintained that the 20 per cent target cannot be met. At the moment, even a five per cent reduction looks ambitious.

As of September 2018, the overall reduction of sugar in shop-bought food amounted to just 2.9 per cent. (The figure for the out of home sector seems bigger but is not weighted by sales so is not comparable.)

This feeble result has come largely from reformulation of breakfast cereals and yoghurts which have fibre and fat as straightforward substitutes, respectively. For products which are inherently sugary - including biscuits, confectionery, ice cream, lollies and puddings - there has been essentially no change.

The likes of Action on Sugar have seized on these figures to bolster their case for the sugar tax to be extended to food. Their argument, such as it is, is that the sugar levy led to a 29 per cent reduction in sugar in soft drinks and a similar tax on food would lead to similar reductions.

This is faulty logic. Replacing sugar with artificial sweeteners in drinks is a simple process (and also a profitable one, since sugar is relatively expensive). There are no technical limitations. Unlike food, drinks don't require sugar for texture, body or weight. The only barrier is consumer acceptance.

The situation is very different in the case of food, especially for inherently sweet products like, er, sweets. If you look at the table above, you will see that the amount of reformulation is more or less directly proportional to technical feasibility. And although there has been some reformulation in most categories, the industry can't force people to eat the reformulated products, hence the sales weighted averages are virtually unchanged in most cases.

This leads us to the most interesting fact in the report...

A rise in sugar consumption at a time when there has been a concerted anti-sugar campaign and a state-led sugar reduction scheme is a pretty epic fail. These figures do not include sugar in soft drinks or in food from the out of home sector, so we cannot say for sure that overall sugar consumption has risen, but it is an awkward fact that a 2.9 per cent reduction in sugar in a wide range of shop-bought food has coincided with a rise in consumption in sugar from those same foods.

It is a reminder that we still live in a more or less free society in which people can buy whatever food they like in whatever quantities they like. It exposes one of the big flaws in Public Health England's cunning plan. The idea is to reduce the sugar content of food while all else remains constant. It assumes no change in consumer behaviour. But there was no reason to assume that all else would remain constant. The public is not as passive as PHE presume.

They would benefit from reading some Adam Smith:

There are two other points worth making. Firstly, the PHE report provides little information about calories. There is not much point reformulating a product with less sugar if it doesn't reduce the calorie count. Coco Pops slashed the amount of sugar by 30 per cent but only reduced energy intake by one calorie per serving. Reformulation of this kind will count for nothing when the companies are given their next target: reducing overall calories by 20 per cent by 2024.

Of the products that have been reformulated in a non-trivial way, only 14 per cent have managed to reduce the amount of saturated fat and the number of calories.

Secondly, Public Health England is very proud of the 'success' of the sugar levy, as in George Osborne...

But if you look at the PHE report, you'll see how trivial the whole business has been. Yes, there has been a significant decline in the amount of sugar consumed in soft drinks, and a lot of that can be attributed to the sugar tax/reformulation, but drinks with more than 8g of sugar per 100ml barely made up a quarter of the soft drinks market before the tax was introduced.

We can be almost certain that the 'stunning success' of the sugar levy will have no impact on obesity, firstly because sugary drink sales have been declining for fifteen years while obesity has risen and secondly because the drop in sugar consumed in drinks since 2015 has been largely offset by the rise in sugar consumed in the foods targeted for reformulation.

As for being 'progressive', the sugar tax is quite literally regressive. Campaigners try to redefine the term 'regressive' and claim that such taxes are actually progressive because the poorest members of society are the most responsive to price hikes and therefore reap the greatest health benefits. Leaving aside the fact that the health benefits are wholly unproven, the PHE report shows that the poorest people have been the least responsive to the sugar levy and have therefore been hardest hit.

If this is progressive, bring back the reactionaries.

Read Josie Appelton's exposé of the food reformulation scheme here.

The plan was for there to be a five per cent reduction across the targeted foods (ie. most food) by 2017 and a 20 per cent reduction by 2020. I have always maintained that the 20 per cent target cannot be met. At the moment, even a five per cent reduction looks ambitious.

As of September 2018, the overall reduction of sugar in shop-bought food amounted to just 2.9 per cent. (The figure for the out of home sector seems bigger but is not weighted by sales so is not comparable.)

This feeble result has come largely from reformulation of breakfast cereals and yoghurts which have fibre and fat as straightforward substitutes, respectively. For products which are inherently sugary - including biscuits, confectionery, ice cream, lollies and puddings - there has been essentially no change.

The likes of Action on Sugar have seized on these figures to bolster their case for the sugar tax to be extended to food. Their argument, such as it is, is that the sugar levy led to a 29 per cent reduction in sugar in soft drinks and a similar tax on food would lead to similar reductions.

This is faulty logic. Replacing sugar with artificial sweeteners in drinks is a simple process (and also a profitable one, since sugar is relatively expensive). There are no technical limitations. Unlike food, drinks don't require sugar for texture, body or weight. The only barrier is consumer acceptance.

The situation is very different in the case of food, especially for inherently sweet products like, er, sweets. If you look at the table above, you will see that the amount of reformulation is more or less directly proportional to technical feasibility. And although there has been some reformulation in most categories, the industry can't force people to eat the reformulated products, hence the sales weighted averages are virtually unchanged in most cases.

This leads us to the most interesting fact in the report...

- overall there has been an increase from 722,976 tonnes of sugar sold at baseline [2015] to 741,700 tonnes in year 2 which represents an increase of 2.6%

- as the population of Great Britain increased during this period the increase in sugar represents a 0.5% increase in sugar purchased per person from product categories included in the programme

- the largest increases in tonnes of sugar sold were 16.3% for ice cream, lollies and sorbets, 10.4% for chocolate confectionery, 6.4% for sweet spreads and sauces, 4.9% for sweet confectionery and 3.1% for biscuits

A rise in sugar consumption at a time when there has been a concerted anti-sugar campaign and a state-led sugar reduction scheme is a pretty epic fail. These figures do not include sugar in soft drinks or in food from the out of home sector, so we cannot say for sure that overall sugar consumption has risen, but it is an awkward fact that a 2.9 per cent reduction in sugar in a wide range of shop-bought food has coincided with a rise in consumption in sugar from those same foods.

It is a reminder that we still live in a more or less free society in which people can buy whatever food they like in whatever quantities they like. It exposes one of the big flaws in Public Health England's cunning plan. The idea is to reduce the sugar content of food while all else remains constant. It assumes no change in consumer behaviour. But there was no reason to assume that all else would remain constant. The public is not as passive as PHE presume.

They would benefit from reading some Adam Smith:

'The man of system, on the contrary, is apt to be very wise in his own conceit; and is often so enamoured with the supposed beauty of his own ideal plan of government, that he cannot suffer the smallest deviation from any part of it. He goes on to establish it completely and in all its parts, without any regard either to the great interests, or to the strong prejudices which may oppose it.

He seems to imagine that he can arrange the different members of a great society with as much ease as the hand arranges the different pieces upon a chess-board. He does not consider that the pieces upon the chess-board have no other principle of motion besides that which the hand impresses upon them; but that, in the great chess-board of human society, every single piece has a principle of motion of its own, altogether different from that which the legislature might choose to impress upon it.'

There are two other points worth making. Firstly, the PHE report provides little information about calories. There is not much point reformulating a product with less sugar if it doesn't reduce the calorie count. Coco Pops slashed the amount of sugar by 30 per cent but only reduced energy intake by one calorie per serving. Reformulation of this kind will count for nothing when the companies are given their next target: reducing overall calories by 20 per cent by 2024.

Of the products that have been reformulated in a non-trivial way, only 14 per cent have managed to reduce the amount of saturated fat and the number of calories.

Secondly, Public Health England is very proud of the 'success' of the sugar levy, as in George Osborne...

The sugar tax is a stunning success - and an example of progressive Conservative policy in action. Number 10 should be celebrating it https://t.co/YuhkirjGSi— George Osborne (@George_Osborne) September 20, 2019

But if you look at the PHE report, you'll see how trivial the whole business has been. Yes, there has been a significant decline in the amount of sugar consumed in soft drinks, and a lot of that can be attributed to the sugar tax/reformulation, but drinks with more than 8g of sugar per 100ml barely made up a quarter of the soft drinks market before the tax was introduced.

We can be almost certain that the 'stunning success' of the sugar levy will have no impact on obesity, firstly because sugary drink sales have been declining for fifteen years while obesity has risen and secondly because the drop in sugar consumed in drinks since 2015 has been largely offset by the rise in sugar consumed in the foods targeted for reformulation.

As for being 'progressive', the sugar tax is quite literally regressive. Campaigners try to redefine the term 'regressive' and claim that such taxes are actually progressive because the poorest members of society are the most responsive to price hikes and therefore reap the greatest health benefits. Leaving aside the fact that the health benefits are wholly unproven, the PHE report shows that the poorest people have been the least responsive to the sugar levy and have therefore been hardest hit.

If this is progressive, bring back the reactionaries.

Read Josie Appelton's exposé of the food reformulation scheme here.

Sunday, 22 September 2019

Nicola Sturgeon lies about minimum pricing

Last week, I mentioned the crude cherry-picking that allowed an advocate of minimum pricing to imply that his pet policy was reducing alcohol-related deaths in Scotland. Thanks to a press release and the media's confirmation bias, this became news.

I see that it has also become a 'fact' cited in the Scottish parliament...

This is a lie. Alcohol-related deaths in Scotland rose in 2018. There is, as yet, no evidence whatsoever that the policy is 'saving lives and improving health'.

It brings to mind the ludicrous Helena Miracle reported in 2003 which claimed a 60 per cent fall in heart attack admissions in a small US town after it introduced a smoking ban. As with the minimum pricing factoid, it was announced at a conference and turned out to be the result of shameless cherry-picking.

Closer to home, it is reminiscent of the equally false claim that Scotland's smoking ban led to an immediate 17 per cent decline in heart attacks. That factoid was also cited in parliament, both in Scotland and London.

Through sheer repetition, the cherry-picked figure from Glasgow may now become the best known fact about minimum pricing. The more relevant fact - that deaths rose in the nation as a whole - has still not been reported by any newspaper and may never be brought to the public's attention.

If so, the scoundrels of 'public health' can rub their grubby little hands and together and congratulate themselves for getting away with it again.

I see that it has also become a 'fact' cited in the Scottish parliament...

Clare Adamson Scottish National Party:

The First Minister will be aware of new research showing that there has been a 21.5 per cent decrease in alcohol-related deaths in Glasgow since the introduction of minimum unit pricing. Does the First Minister agree with the British Liver Trust that Parliaments across these islands should get on with the day job and follow Scotland’s lead in the area?

Nicola Sturgeon Scottish National Party:

Yes, I strongly agree with the British Liver Trust. I am proud that the Parliament introduced minimum unit pricing. It is of course early days for that policy, and a full review is built into the legislation. However, all the early indications, including the statistic from Glasgow that Clare Adamson referred to, suggest that the policy is working and is saving lives and improving health for people across the country. I am proud of the policy, and I think that the Parliament should be proud of it. Although it is for others to make their decisions, I encourage other Governments and Parliaments across not just the rest of the UK but the world to look at the policy and consider implementing it in their countries.

This is a lie. Alcohol-related deaths in Scotland rose in 2018. There is, as yet, no evidence whatsoever that the policy is 'saving lives and improving health'.

It brings to mind the ludicrous Helena Miracle reported in 2003 which claimed a 60 per cent fall in heart attack admissions in a small US town after it introduced a smoking ban. As with the minimum pricing factoid, it was announced at a conference and turned out to be the result of shameless cherry-picking.

Closer to home, it is reminiscent of the equally false claim that Scotland's smoking ban led to an immediate 17 per cent decline in heart attacks. That factoid was also cited in parliament, both in Scotland and London.

Through sheer repetition, the cherry-picked figure from Glasgow may now become the best known fact about minimum pricing. The more relevant fact - that deaths rose in the nation as a whole - has still not been reported by any newspaper and may never be brought to the public's attention.

If so, the scoundrels of 'public health' can rub their grubby little hands and together and congratulate themselves for getting away with it again.

Friday, 20 September 2019

Child exploitation in Scotland

This is creepy and disturbing. The Scottish government has formed a 'Children's Parliament' of 9 to 11 year olds. They put these kids in a room with Alison Douglas from the state-funded temperance group Alcohol Focus Scotland and filled their heads with anti-alcohol policies which they then regurgitated on camera and in a report.

As the Scotsman reports...

Members of children’s parliament want alcohol to be made ‘less visible’

Members of Scotland’s Children’s Parliament have called for alcohol to be made less visible and for tougher measures to stop people drinking in public spaces.

A new report published today – compiled with the help of nine members of the Children’s Parliament – used workshops with 90 primary school pupils between the ages of nine and 11.

.. The report concluded alcohol should be made less visible in shops and on TV, as well as calling for the removal of adverts from billboards.

The Children’s Parliament also called for an end to alcohol firms sponsoring events at which children will be present.

Does anyone seriously believe that primary school children came up with these policies off the top of their heads? This is propaganda of the crudest variety.

Alison Douglas, chief executive of Alcohol Focus Scotland, which aided in the research, said:

... “The Scottish Government’s forthcoming consultation on alcohol marketing provides a real opportunity to show we are listening to children and will take action to protect and promote their right to grow up healthy and happy, free from alcohol harm.”

So the Scottish government has a public consultation on alcohol on the way. The government funds its own anti-alcohol lobby groups, of which Alcohol Focus Scotland is one. It convenes a group of children who are, aparently, too young to be exposed to the sight of beer in shops but are old enough to make detailed policy proposals. And their policy proposals are going to be fed into the consultation as not only the views of the public but of the chiiiiiildren.

If this was happening in some benighted dictatorship overseas, we would not hesitate to mock it as the brazzen parody of democracy it is.

Cathy McCulloch, co-director of the Children’s Parliament said: “Children have the right to have their voices heard in matters that affect them and we, as adults, have a responsibility to listen and respond."

Ooh, the children have spoken! We'd better do what they say. Don't want to disrespect the children.

Give me a break.

Public health minister Joe FitzPatrick also supported the work, saying the voice of children should be heard on this issue.

He said: “It is crucial that we seek and listen to the views of children and young people in determining how best to prevent and reduce the impact of alcohol on them.”

Is that, by any chance, because you can get them to say whatever you want to hear?

The recommendations put forward by these little kids (sorry, 'Members of Children Parliament Investigators'), as recorded in the report, include such pearls as:

Investigators recommend that hotel room minibars do not include alcohol and that adults reconsider all-inclusive holiday packages which include alcohol.

And...

Investigators called for alcohol to be sold in adult-only sections of shops, separate rooms in regular shops and supermarkets dedicated to alcohol sales.

I'm not saying that it's impossible for 9-11 year olds to spontaneously come up with ideas like this - ideas which just happen to be Alcohol Focus Scotland policy. I'm just saying that they didn't.

Watch these poor, exploited kids reading the scripts that have been written for them. They are too young to have given meaningful consent to be used like this.

Ridiculous.

Thursday, 19 September 2019

Minimum pricing: media fall for blatant cherry-picking

A few months ago, I lamented the media giving wall-to-wall coverage of the news that alcohol sales fell in Scotland in 2018 while ignoring the news that alcohol-related deaths rose in Scotland in 2018. For the purposes of the 'public health' lobby, 2018 was 'after minimum pricing', although minimum pricing wasn't introduced until May of that year.

As I said in June when the National Records of Scotland released the alcohol-related mortality figures to a seemingly uninterested world...

Today we have seen that the media are interested in what happened to alcohol-related deaths in Scotland in 2018 - so long as the figures are spun in a way that is helpful to minimum pricing campaigners.

The Times:

ITV:

And, of course, the BBC:

None of these reporters showed any interest when the National Records of Scotland released data showing that the number of alcohol-related deaths rose from 1,120 in 2017 to 1,136 in 2018. But they have become very interested now that a longtime supporter of minimum pricing has announced the results of some unpublished research at a conference.

'Research' might be too strong a word. All he done is go to the data released in June, found the spreadsheet that shows the number of deaths by local authority area, and cherry-picked one where the number of deaths went down - against the national trend. (See Excel spreadsheet, tab 5.)

If he had picked Aberdeen City, he could have announced that the number of alcohol-related deaths rose by 51 per cent 'after minimum pricing'. If he'd picked Perth and Kinross, he could have claimed that they rose by 76 per cent.

None of this would be untrue per se, but it would be lying by omission. If we want to know what happened to alcohol-related deaths in Scotland, all we need to do is look at the number of alcohol-related deaths in Scotland, which is right there on the same spreadsheet. It rose by 1.4 per cent.

As junk science goes, this doesn't even have the merit of being sophisticated. It is straightforward cherry-picking. It could be checked and debunked by any responsible journalist in a matter of minutes.

It is difficult to resist the suspicion that the media, especially in Scotland, are simply not interested in the truth of the matter. They only want to hear that minimum pricing has worked.

UPDATE

Here's the conference that started all this. The speaker is Ewan Forrest, the guy who carried out the 'research'.

The claim is that off-trade sales fell in Scotland but rose in England. From the figures I've seen, this is not true. Sales rose in both countries.

Be that as it may, the key claims relate to alcohol-related deaths. Forrest admits that there was 'no immediate effect upon overall figures for alcohol-related deaths in Scotland in 2018'. If he were to be more precise, he would say that they rose.

His slide then mentions 'possible early evidence of MUP effect in Glasgow' (the cherry-picked and unrepresentative decline) but says 'it is still too early to determine definite long-term clinical benefit'.

Hardly sufficient to justify the claims from the press today - which were further exaggerated by campaigners - but, as I say, few people now care about the facts.

As I said in June when the National Records of Scotland released the alcohol-related mortality figures to a seemingly uninterested world...

All I want here is a bit of consistency. If we're going to pretend that the calendar year of 2018 was the post-MUP period and use post hoc rationale, then minimum pricing drove down alcohol consumption while failing to reduce alcohol-related deaths. Today's statistics should have received at least as much attention as the sales figures did last week ('the whole policy here is about reducing alcohol related harm', after all).

Instead, today's figures have been released to the sound of crickets and tumbleweed.

Ever get the feeling you're being played?

Today we have seen that the media are interested in what happened to alcohol-related deaths in Scotland in 2018 - so long as the figures are spun in a way that is helpful to minimum pricing campaigners.

The Times:

Fewer deaths after minimum alcohol pricing, Glasgow doctors say

Drink-related deaths plunged in Glasgow after Scotland set a minimum price for alcohol, researchers have revealed.

ITV:

Alcohol-related deaths ‘cut by more than 20% with minimum unit pricing’

Minimum unit pricing may have contributed to the number of alcohol-related deaths in Glasgow falling by more than a fifth, according to new research.

And, of course, the BBC:

Charity calls for alcohol minimum pricing to be extended across UK

A charity has called for Scotland's minimum unit pricing policy for alcohol (MUP) to be rolled out across the UK.It followed the publication of evidence suggesting MUP has had a significant impact on drinking patterns.

Data presented at a conference in Glasgow suggested alcohol-related deaths in the city had fallen by 21.5%.

The policy was introduced in May 2018, but organisers said there was already an indication it was working - and should be more widely applied.

None of these reporters showed any interest when the National Records of Scotland released data showing that the number of alcohol-related deaths rose from 1,120 in 2017 to 1,136 in 2018. But they have become very interested now that a longtime supporter of minimum pricing has announced the results of some unpublished research at a conference.

'Research' might be too strong a word. All he done is go to the data released in June, found the spreadsheet that shows the number of deaths by local authority area, and cherry-picked one where the number of deaths went down - against the national trend. (See Excel spreadsheet, tab 5.)

If he had picked Aberdeen City, he could have announced that the number of alcohol-related deaths rose by 51 per cent 'after minimum pricing'. If he'd picked Perth and Kinross, he could have claimed that they rose by 76 per cent.

None of this would be untrue per se, but it would be lying by omission. If we want to know what happened to alcohol-related deaths in Scotland, all we need to do is look at the number of alcohol-related deaths in Scotland, which is right there on the same spreadsheet. It rose by 1.4 per cent.

As junk science goes, this doesn't even have the merit of being sophisticated. It is straightforward cherry-picking. It could be checked and debunked by any responsible journalist in a matter of minutes.

It is difficult to resist the suspicion that the media, especially in Scotland, are simply not interested in the truth of the matter. They only want to hear that minimum pricing has worked.

UPDATE

Here's the conference that started all this. The speaker is Ewan Forrest, the guy who carried out the 'research'.

The claim is that off-trade sales fell in Scotland but rose in England. From the figures I've seen, this is not true. Sales rose in both countries.

Be that as it may, the key claims relate to alcohol-related deaths. Forrest admits that there was 'no immediate effect upon overall figures for alcohol-related deaths in Scotland in 2018'. If he were to be more precise, he would say that they rose.

His slide then mentions 'possible early evidence of MUP effect in Glasgow' (the cherry-picked and unrepresentative decline) but says 'it is still too early to determine definite long-term clinical benefit'.

Hardly sufficient to justify the claims from the press today - which were further exaggerated by campaigners - but, as I say, few people now care about the facts.

Wednesday, 18 September 2019

India bans e-cigarettes, tobacco stocks rally

The vape scare continues in the USA. As the Centers for Disease Control launches an 'investigation' into a problem that has obviously been the result of illegal THC cartridges from the start, major news networks put out garbage like this...

The scare is reverberating around the world, doubtless to the satisfaction of those who have been coordinating it.

Last week, the Australian government seized on the moral panic to justify its antediluvian approach to tobacco harm reduction:

The Australian Medical Association has also tried to exploit the US problem to support its ethically and scientifically indefensible position. Its flargrantly dishonest press release mentions neither THC nor the black market.

And today, the Indian government has done what it always wanted to do and introduced prohibition...

India's parliament is not currently in session so the government - laughably - passed the prohibition as an 'emergency'.

Sitharaman apparently referred to some mythical evidence showing that smokers don't use e-cigarettes as a substitute for cigarettes:

The market knows better, however...

Fancy that.

The CDC has now activated its Emergency Operations Center to investigate the mysterious illness believed to be related to vaping that has sickened hundreds and claimed the lives of at least seven people.

Here’s everything you need to know about America’s vaping epidemic. pic.twitter.com/V3GJXi1LmZ— TODAY (@TODAYshow) September 17, 2019

The scare is reverberating around the world, doubtless to the satisfaction of those who have been coordinating it.

Last week, the Australian government seized on the moral panic to justify its antediluvian approach to tobacco harm reduction:

E-cigarettes are relatively new products and further research is needed to understand their long term impacts. However, increasing evidence reinforces the need to maintain, and where appropriate, strengthen the controls.

Who is at risk?

Anyone using e-cigarette products or who is exposed to e-cigarette emissions and/or e liquids is potentially at risk. This includes but is not limited to young people, pregnant women and their unborn children.

The Australian Medical Association has also tried to exploit the US problem to support its ethically and scientifically indefensible position. Its flargrantly dishonest press release mentions neither THC nor the black market.

And today, the Indian government has done what it always wanted to do and introduced prohibition...

The Union Cabinet in its meeting on Wednesday approved the banning of e-cigarettes in the country.

Finance minister Nirmala Sitharaman announcing the ban said that production, manufacturing, import, export, storage, distribution, and transport of e-cigarettes will be banned in the country and an ordinance will be promulgated soon to the effect.

India's parliament is not currently in session so the government - laughably - passed the prohibition as an 'emergency'.

Sitharaman apparently referred to some mythical evidence showing that smokers don't use e-cigarettes as a substitute for cigarettes:

She said that e-cigarettes were initially projected as means to wean away from the practice of smoking. However, reports say that actually e-cigarettes are no longer used as means to wean away from smoking.

The market knows better, however...

Shares of cigarette maker Godfrey Philips surged 9 percent to Rs 1,023.30 per share on BSE after the government-approved ban. Meanwhile, ITC — whose cigarette division contributes 45.8 percent of total revenue — also gained 1.9 percent to Rs 241.75 post the announcement.

Fancy that.

Tuesday, 17 September 2019

Last Orders with Mark Littlewood

The latest Last Orders podcast went up over the weekend. This month, Tom Slater and I were joined by my IEA boss Mark Littlewood. It was recorded as the US vaping panic began to reach its crescendo. At the time, there had been one 'vaping-related' death and we did not have many facts available as we do now, but I think the gist of what I said holds up.

We also talked about the UK government's crazy food reformulation scheme and its ban on 'sexist' adverts.

Have a listen.

We also talked about the UK government's crazy food reformulation scheme and its ban on 'sexist' adverts.

Have a listen.

Monday, 16 September 2019

Evidence? We don't need no stinking evidence!

The Royal Society of Public Health produced a report last week calling for a ban on fast food shops opening within 400 metres of a school. In effect, this means a near-total ban in most cities.

They also want some form of regulation to clamp down on the shops that already exist...

To this end, they suggest banning the sale of food to children and banning shops from opening 'during the post-school hours of the day'.

What could possibly justify such state interference in the out-of-home food market? There must be masses of evidence showing a strong link between fast food outlets near schools and child obesity, right?

Wrong. When I conducted a systematic review last year, I found 74 relevant studies. Of these...

And the evidence that fast food availability causes obesity among children is even weaker...

So how does the RSPH justify its proposals? It says...

'A number' is doing a lot of heavy lifting in that sentence. Does the RSPH summarise the literature? Does it cite any of the seven systematic reviews that have been conducted, all of which concluded that the link between fast food outlet proximity and obesity is extremely weak, at best?

It does not. The RSPH cites just two studies. One of them is a recent study from America which found an association between the body mass index of adult employees (not children) and the number of supermarkets, grocery stores and fast food outlets on their commute route (but not near their workplace).

The other is a study from the UK which showed that adults (not children) who live near lots of takeaway outlets consume fewer calories and had a slightly lower body weight than those who didn't. As the statistician Jeremy Franklin pointed out, the authors had to make some dramatic adjustments to the data to turn those findings on their head, and even this required supermarkets to be defined as 'takeaway food outlets'. If you exclude supermarkets, there is no association under any model.

Not the most compelling evidence then, but even if the studies were stronger it would still be wrong to cherry-pick two studies out of 70-odd.

'Public health' is not an evidence-based enterprise. The RSPH have found a policy they like and they want to do it because they want to do it.

They also want some form of regulation to clamp down on the shops that already exist...

We are calling for local authorities to introduce planning restrictions on fast food in their local planning schemes; however, it must be noted that this approach is necessarily limited as it can only be used to stop outlets opening, and not to close existing ones. While it is important that comprehensive planning policies are in place so that fast food prevalence near schools cannot increase, it is also vital that councils are able to reduce the current number of outlets near schools (or at least their sales of unhealthy food to school children) – which is already unacceptably high in many areas.

To this end, they suggest banning the sale of food to children and banning shops from opening 'during the post-school hours of the day'.

What could possibly justify such state interference in the out-of-home food market? There must be masses of evidence showing a strong link between fast food outlets near schools and child obesity, right?

Wrong. When I conducted a systematic review last year, I found 74 relevant studies. Of these...

… only fifteen (20%) found a positive association between the proximity and/or density of fast food outlets and obesity/body mass index. Forty-four (60%) found no positive association, of which eleven (15%) found evidence that living near a fast food outlet reduced the risk of putting on weight. Fifteen (20%) produced a mix of positive, negative and (mostly) null results, which, taken together, point to no particular conclusion.

And the evidence that fast food availability causes obesity among children is even weaker...

Of the 39 studies that looked specifically at children, only six (15%) found a positive association while twenty-six (67%) found no effect. Seven (18%) produced mixed results. Of the studies that found no association, five (13%) found an inverse relationship between fast food outlets and childhood obesity. Two-thirds of the studies found no evidence for the hypothesis that living near fast food outlets increases the risk of childhood obesity and there are nearly as many studies suggesting that it reduces childhood obesity as there are suggesting the opposite.

So how does the RSPH justify its proposals? It says...

A number of studies both at home and abroad have indicated a significant link between repeated exposure to fast food outlets along daily commutes, fast food consumption, and obesity.

'A number' is doing a lot of heavy lifting in that sentence. Does the RSPH summarise the literature? Does it cite any of the seven systematic reviews that have been conducted, all of which concluded that the link between fast food outlet proximity and obesity is extremely weak, at best?

It does not. The RSPH cites just two studies. One of them is a recent study from America which found an association between the body mass index of adult employees (not children) and the number of supermarkets, grocery stores and fast food outlets on their commute route (but not near their workplace).

The other is a study from the UK which showed that adults (not children) who live near lots of takeaway outlets consume fewer calories and had a slightly lower body weight than those who didn't. As the statistician Jeremy Franklin pointed out, the authors had to make some dramatic adjustments to the data to turn those findings on their head, and even this required supermarkets to be defined as 'takeaway food outlets'. If you exclude supermarkets, there is no association under any model.

Not the most compelling evidence then, but even if the studies were stronger it would still be wrong to cherry-pick two studies out of 70-odd.

'Public health' is not an evidence-based enterprise. The RSPH have found a policy they like and they want to do it because they want to do it.

Thursday, 12 September 2019

Public Health England admits that its policies won't reduce childhood obesity

According to the Daily Mail...

No. That's the number of children who are classed as overweight or obese. The childhood obesity measure has no basis in reality, and the overweight measure is even more absurd. None of the children who are classed as overweight are fat, nor are most of those who are classed as obese.

If you look at the projection, PHE reckons the number of 11 year olds with 'excess weight' will rise from 34.3 per cent to 35.7 per cent, but the confidence interval ranges from 33.2% to 38.1% so it doesn't really tell you anything, even if obesity predictions were based on something more than guesswork, which they aren't, and if the government's measure of childhood obesity reflected childhood obesity rates, which it doesn't.

In any case, obesity forecasts are consistently wrong.

Childhood obesity rates in the UK are to continue to spiral over the next five years, a damning report has found.

Continue to spiral? Let's have a look at the existing trend from the Health Survey for England.

If it looks like the rate hasn't risen for fifteen years and is lower than it once was, congratulations, there is nothing wrong with your eyes.

In its latest forecast, Public Health England predicts the number of obese primary school children could jump by up to four per cent by 2024.More than 34 per cent of 10 and 11 year olds are currently classified as obese, with the new forecast now between 33.4 per cent and 38.1 per cent.

No. That's the number of children who are classed as overweight or obese. The childhood obesity measure has no basis in reality, and the overweight measure is even more absurd. None of the children who are classed as overweight are fat, nor are most of those who are classed as obese.

If you look at the projection, PHE reckons the number of 11 year olds with 'excess weight' will rise from 34.3 per cent to 35.7 per cent, but the confidence interval ranges from 33.2% to 38.1% so it doesn't really tell you anything, even if obesity predictions were based on something more than guesswork, which they aren't, and if the government's measure of childhood obesity reflected childhood obesity rates, which it doesn't.

In any case, obesity forecasts are consistently wrong.

Professor John Newton, the PHE's director of health improvement, admitted it was a 'reminder we need to redouble our efforts on childhood obesity'.

Ah, yes. Doubtless this was the entire purpose of this worthless prediction.

But he claimed it was 'important not to interpret this trend as a sign that what we're doing at the moment isn't working'.

Heaven forfend! What a balancing act Professor Newton is having to perform. It must be tricky trying to scare the public into believing that the situation will get worse having introduced policies that you insist will make the situation better.

By 2024, Public Health England intends to have taken 20 per cent of calories out of food. Its target for taking 20 per cent of sugar out of food is supposed to have been reached by next year. By 2024, the sugar levy will have been in place for six years. And yet the impact of all this (and more) on childhood obesity will, according to PHE's own figures, be diddly-squat. Can we have our money back please?

Out of around 556,000 children of primary school-leaving age in the UK, 170,000 are overweight to some degree, figures showed in May last year.

Where are they? Show me them.

Professor Newton also called for tighter advertising laws around promoting junk food to children.

Of course he did.

'Advertising is the other thing - there is good evidence we need to ensure children and families are not bombarded by advertising for unhealthy foods,' he said.

Thus, Public Health England continues to sell us a web of lies. Its measure of childhood obesity is obviously, demonstrably, laughably wrong. Its projections are based on nothing. Its anti-obesity policies have not worked in the past and will not work in the future.

Can we shut this money pit down now?

Wednesday, 11 September 2019

The American Vape Scare

The USA is in the grip of a classic moral panic about vaping. It’s been years in the making and is now reaching its crescendo.

The spark came from a spate of health problems caused by black market THC vape cartridges which seem to have been cut with dangerous thickening agents. America’s mendacious anti-vaping lobby has capitalised on these individual tragedies and seems on the verge of banning e-cigarette flavours.

They are beneath contempt, as is that hateful skeleton Mike Bloomberg who has just given £160 million to science-denying bottom-feeders to stamp out vaping.

I have written about this for Spiked. Have a read.

The spark came from a spate of health problems caused by black market THC vape cartridges which seem to have been cut with dangerous thickening agents. America’s mendacious anti-vaping lobby has capitalised on these individual tragedies and seems on the verge of banning e-cigarette flavours.

They are beneath contempt, as is that hateful skeleton Mike Bloomberg who has just given £160 million to science-denying bottom-feeders to stamp out vaping.

I have written about this for Spiked. Have a read.

Tuesday, 10 September 2019

Sugar levy cash gets swallowed

Last summer the IEA published a little paper written by me about sin taxes. In it, I mentioned the ringfencing trick in which politicians and campaigners lure voters to sin taxes by promising the money will be hypothecated for feelgood causes.

Recent examples of soda tax revenue being syphoned off to the general pot after being promised for cuddly initiatives include Philadelphia and Oakland.

When the UK government promised to use the filthy lucre from the sugar levy to fund a school's breakfast programme and school sports, I thought there was a chance that it would happen. It was such a high profile commitment.

But it seems that I was not cynical enough...

And the earth still shifts on its orbit.

Good.

Might as well scrap the tax then, eh?

.. history shows us that tax hypothecation is rare. The public are more likely to support sin taxes if they are told that the revenue will be ring-fenced for health or education, but the money is usually diverted towards general state spending sooner or later (Hoffer and Pellillo 2012; Jacobson and Brownell 2000). Tobacco and alcohol taxes have been used to finance routine government expenditure for centuries and if the USA is any guide, sugary drink tax revenue will be treated no differently (Tanenbaum 2018).

Recent examples of soda tax revenue being syphoned off to the general pot after being promised for cuddly initiatives include Philadelphia and Oakland.

When the UK government promised to use the filthy lucre from the sugar levy to fund a school's breakfast programme and school sports, I thought there was a chance that it would happen. It was such a high profile commitment.

But it seems that I was not cynical enough...

Sajid Javid admits Treasury has swallowed sugar tax cash

The Treasury has pocketed taxes raised through the soft drinks sugar levy that were supposed to support children’s health, new chancellor Sajid Javid has admitted.

This week’s spending review promised an extra £13.4bn in public spending for 2020-21 as he promised to “turn the page on austerity”.

However, the Treasury confirmed that earlier commitments to ringfence the taxes raised by the levy to help tackle the obesity crisis in schools had been dropped.

Forecast to raise £340m in 2020-1, the prospect of the sugar tax disappearing into the Treasury’s coffers appeared was confirmed as the review failed to contain any commitment to ringfence the income for spending on programmes to improve children’s health and food.

And the earth still shifts on its orbit.

It was met with fury by campaigners who accused the government of backtracking on a promise to help children in schools via the tax.

Good.

“We’re profoundly disappointed not to get a clear reassurance from the chancellor today that the levy on sugary drinks would continue to deliver a direct dividend for children’s health,” said Children’s Food Campaign co-ordinator Barbara Crowther.

Might as well scrap the tax then, eh?

Monday, 9 September 2019

Soda taxes still not working

A noted anti-obesity campaigner was recently celebrating Scotland introducing more nanny state laws and promised that evidence of their efficacy would be forthcoming. When I asked her about this evidence, she told me that you would have to be literally crazy to expect an anti-obesity policy to actually reduce obesity.

Note that I didn't ask for this tranche of policies to 'solve' obesity, merely that they would reduce it somewhat. She seems to think that they won't, so that makes two of us.

Meanwhile, real world evidence on sugar taxes continues to appear.

Yet another 'public health' win!

Note that I didn't ask for this tranche of policies to 'solve' obesity, merely that they would reduce it somewhat. She seems to think that they won't, so that makes two of us.

Meanwhile, real world evidence on sugar taxes continues to appear.

Oakland's Sugar-Sweetened Beverage Tax: Impacts on Prices, Purchases and Consumption by Adults and Children

We find that roughly 60 percent of the tax was passed on to consumers in the form of higher prices. There was a slight decrease in the volume of SSBs purchased per shopping trip in Oakland and a small increase in purchases at stores outside of the city, and we find some evidence of increased shopping by Oakland residents at stores outside of the city.

We do not find evidence of substantial changes in the overall consumption of SSBs or of added sugars consumed through beverages for either adults or children after the tax.

Yet another 'public health' win!

Friday, 6 September 2019

The Social Market Foundation's alcohol tax report

In a report that was "kindly supported" by the Institute of Alcohol Studies (neé UK Temperance Alliance), the Social Market Foundation calls for a reform of Britain's alcohol duty system. They rightly point out that the system is incoherent and irrational. I said likewise in 2017 when I proposed taxing all units of alcohol at the same rate to make the system genuinely Pigouvian. This implied a flat rate of 9p per unit and a large decline in the amount raked in by the government.

The SMF are broadly right about what is wrong.

This is because the UK has traditionally imported its wine while producing its own cider, but that is not a valid reason.

It would be easy to misread this as saying that the impact on 'direct consumers of alcohol' is an externality. Obviously it isn't, but assuming that's not what they mean, they are right.

Very true.

Also very true.

Indeed. Economists are generally dismissive of jobs-based arguments. A reduction of employment in one area tends to lead to a growth in another.

But the SMF is also wrong about quite a lot too...

That's not a jobs argument. People dying doesn't cause unemployment, just as people being born doesn't reduce unemployment.

Only if you look at people as groups. If you look at individual drinkers, it is clearly regressive.

That's a matter of opinion.

This is a statistic that first appeared in Public Health England's woeful report on alcohol which quickly turned into the claim that alcohol misuse costs society 'up to £52bn a year, far more than previously thought'. This is based on looking at a range of international estimates which do indeed range from 1.3% to 2.5% and picking the biggest one.

But guess where the cost is estimated at 1.3%. That's right: the UK. So it's not necessary to use a range of estimates from around the world to estimate the UK figure when one of those figures is the UK itself, is it? This is a small but typical example of the 'public health' lobby lying with statistics.

Moreover, that estimate of 1.3% (£21 billion) is nearly 20 years old and is mostly made up of costs that are not external.

This is based on the discredited lie that it is hazardous to drink more than 14 units a week.

That evidence is very weak.

The SMF have five main policy recommendations:

If you have a flat tax on each unit of alcohol, stronger drinks are taxed more almost by definition. That should be sufficient. If, however, it could be shown that certain drinks create greater externalities, a case could be made for the kind of system proposed by the SMF. There is some evidence for this, but it is far from clear that taxing those drinks more would not simply displace consumption, with the effect that another form of alcohol becomes associated with the same externalities.

So do I.

No one loves pubs more than me, but this sounds like the kind of tweaking of the system according to political whims that the SMF complain about at the start of their report.

To be fair, they come up with a superficially plausible justification for what seems like rent-seeking...

This could be right but there are reasons to doubt it. Whilst the majority of health harms are linked to off-trade alcohol (most alcohol is sold on the off-trade, after all), those harms are to the drinker and are thus not externalities (for the most part, at least). It is less clear that the external harms are disproportionately associated with the off-trade. Most alcohol-related violence takes place in and around the on-trade. Drink driving is also, I suspect, more closely linked to the on-trade than the off-trade.

In any case, if this is an attempt to 'support the pub sector', as the BBC claims, the SMF's own figures show that it won't work:

I have explained one of the reasons for this here.

It should cover the net externalities, yes.

At this point, regrettably, the influence of the 'Institute of Alcohol Studies' becomes apparent...

Coercive paternalism has no place in a free society and there is no point producing a lengthy report about alcohol taxation if you're going to throw out your economic analysis and resort to saying 'but muh paternalism'.

You work for a think tank, for God's sake. Get off the fence!

Drinkers already pay the private costs. If you pretend those costs are externalities and add them to the tax, they end up paying twice. There is no ethical or economic justification for that.

I'm comfortable with automatically increasing the tax by the rate of inflation once we've reformed the system. In practice, that means significantly reducing the rate of tax charged on most, but not all, drinks.

The SMF are broadly right about what is wrong.

While a relatively weak 6% ABV bottle of wine faces duty of 50 pence per unit of alcohol, as of the time of writing a 6% ABV cider faces duty of just 7 pence per unit of alcohol.

This is because the UK has traditionally imported its wine while producing its own cider, but that is not a valid reason.

Given that alcohol consumption generates externalities – impacting government, families and other individuals as well as the direct consumers of alcohol – the overall rate of alcohol taxation should be reflective of the size of these externalities.

It would be easy to misread this as saying that the impact on 'direct consumers of alcohol' is an externality. Obviously it isn't, but assuming that's not what they mean, they are right.

Brexit could open up possibilities to rationalise alcohol taxation in the UK.

Very true.

Given the political nature of duty changes, the UK has been lumbered with a system of alcohol taxation ill-suited for meeting key objectives of government: raising tax revenue, protecting jobs or improving public health and other social outcomes. Rather than examining the evidence base and reflecting on the alcohol duty regime as a whole, the system has been tweaked according to political whims over time.

Also very true.

Arguments often used to justify duty freezes and favourable treatment for certain beverages are deeply flawed. For example, jobs-based arguments used to justify cider and spirits duty freezes ignore the fact that cider accounts for a very small number of jobs in the economy

Indeed. Economists are generally dismissive of jobs-based arguments. A reduction of employment in one area tends to lead to a growth in another.

But the SMF is also wrong about quite a lot too...

Jobs-based arguments also ignore work lost through excessive alcohol consumption. Analysis by Public Health England found that, in 2015, there were 167,000 working years of life lost due to alcohol consumption – 16% of all working years lost in that year.

That's not a jobs argument. People dying doesn't cause unemployment, just as people being born doesn't reduce unemployment.

Arguments related to the regressive nature of excise duties are also flawed. Firstly, alcohol taxation does not appear to be particularly regressive, given relatively high rates of non-drinking among lower income households.

Only if you look at people as groups. If you look at individual drinkers, it is clearly regressive.

Secondly, regressivity alone is not a strong argument against alcohol duty.

That's a matter of opinion.

Studies suggest that the total costs of alcohol to UK society could stand at between 1.3% and 2.5% of GDP.

This is a statistic that first appeared in Public Health England's woeful report on alcohol which quickly turned into the claim that alcohol misuse costs society 'up to £52bn a year, far more than previously thought'. This is based on looking at a range of international estimates which do indeed range from 1.3% to 2.5% and picking the biggest one.

But guess where the cost is estimated at 1.3%. That's right: the UK. So it's not necessary to use a range of estimates from around the world to estimate the UK figure when one of those figures is the UK itself, is it? This is a small but typical example of the 'public health' lobby lying with statistics.

Moreover, that estimate of 1.3% (£21 billion) is nearly 20 years old and is mostly made up of costs that are not external.

Hazardous and harmful drinkers account for a staggering 78% of alcohol consumed in England.

This is based on the discredited lie that it is hazardous to drink more than 14 units a week.

There is also growing evidence suggesting that even moderate rates of alcohol consumption are associated with higher risks of cancer.

That evidence is very weak.

The SMF have five main policy recommendations:

1. Introducing a duty strength escalator, to focus alcohol duty on the higher strength products disproportionately consumed by heavy drinkers, and create stronger incentives to produce lower strength products.

If you have a flat tax on each unit of alcohol, stronger drinks are taxed more almost by definition. That should be sufficient. If, however, it could be shown that certain drinks create greater externalities, a case could be made for the kind of system proposed by the SMF. There is some evidence for this, but it is far from clear that taxing those drinks more would not simply displace consumption, with the effect that another form of alcohol becomes associated with the same externalities.

2. Levelling the playing field across same-strength products. Products of the same strength should face the same rate of duty and duty should be a function of the pure alcohol content of drinks, rather than the volume of the final product. This would help simplify the alcohol duty system.

.. We recommend taxing alcohol on a consistent basis, according to the pure alcohol content of the beverage.

So do I.

3. Allowing pubs to claim back a proportion of alcohol duty through a new “Pub Relief”. This would focus alcohol duty on the off-trade, which is particularly reliant on sales to hazardous and harmful drinkers.

.. We assume that our proposed “Pub Duty Relief” rate is set at 50% - meaning that duty rates in the on-trade are half as much, per unit of alcohol, than on the off-trade.

No one loves pubs more than me, but this sounds like the kind of tweaking of the system according to political whims that the SMF complain about at the start of their report.

To be fair, they come up with a superficially plausible justification for what seems like rent-seeking...

...heavier drinkers are more likely to consume alcohol on the off-trade. Therefore, in line with our proposed framework of focusing alcohol duty where harms are most generated, we suggest explicitly favouring on-trade consumption of alcohol in the tax system.

This could be right but there are reasons to doubt it. Whilst the majority of health harms are linked to off-trade alcohol (most alcohol is sold on the off-trade, after all), those harms are to the drinker and are thus not externalities (for the most part, at least). It is less clear that the external harms are disproportionately associated with the off-trade. Most alcohol-related violence takes place in and around the on-trade. Drink driving is also, I suspect, more closely linked to the on-trade than the off-trade.

In any case, if this is an attempt to 'support the pub sector', as the BBC claims, the SMF's own figures show that it won't work:

The impact of switching to the duty regime described above would be to cut overall alcohol consumption by 5.4%, compared to the current regime. This would come from a 1.9% decline in on-trade alcohol consumption and a 6.8% decline in off-trade consumption.

On-trade consumption of alcohol falls, in the model, despite declines in on-trade prices. This reflects cross elasticities of demand for alcohol products. Increased prices in the off-trade can reduce demand in the on-trade as well.

I have explained one of the reasons for this here.

4. Explicitly linking alcohol duty to the social costs of alcohol, rather than treating it as a cash cow. At the very least, alcohol duty should cover the health, crime and welfare costs to government and wider society (the “externalities” associated with alcohol consumption).

It should cover the net externalities, yes.

At this point, regrettably, the influence of the 'Institute of Alcohol Studies' becomes apparent...

Paternalistic arguments, which consider the ability of individuals to make “bad” and regrettable lifestyle choices (such as those that undermine their job prospects), could justify a higher tax take.

Coercive paternalism has no place in a free society and there is no point producing a lengthy report about alcohol taxation if you're going to throw out your economic analysis and resort to saying 'but muh paternalism'.

.. We do not take a strong position on the degree of paternalism that should be embedded in the alcohol duty system in this report – ultimately, we believe this is a matter for politicians and the electorate.

You work for a think tank, for God's sake. Get off the fence!

Our key argument is that tax take from alcohol duty should be focused on alcohol-related costs, whether that be the externalities of alcohol consumption or a broader measure covering private costs drinkers.

Drinkers already pay the private costs. If you pretend those costs are externalities and add them to the tax, they end up paying twice. There is no ethical or economic justification for that.

5. Regularising the uprating of alcohol duty, with inflation or earnings uprating being the “norm”. This would help depoliticise the setting of alcohol duty.

I'm comfortable with automatically increasing the tax by the rate of inflation once we've reformed the system. In practice, that means significantly reducing the rate of tax charged on most, but not all, drinks.

Thursday, 5 September 2019

Next up: the snack tax

With crushing inevitability, the first UK modelling study promoting a tax on food has been published in the BMJ. And guess what? The researchers reckon that it will work. In fact, they think it will work even better than taxes on sugary drinks - which have never worked anywhere. An accompanying editorial in the journal gives the policy its blessing.

The BMJ's modelling study promoting sugary drink taxes has now been largely forgotten, despite being highly influential at the time, but it promised a fall in obesity of 1.3 per percentage points. Today's study predicts a decline of 2.7 percentage points.

One of the authors told the Guardian:

'Public health' has a wretched record of health-economic modelling. It repeatedly promises outcomes that are not delivered and then uses retrospective modelling to make it look as if they were (eg. Mexican sugar tax, English smoking ban).

Models are only as good as the assumptions fed into them by the researchers. If the researchers tell the model that the policy will work, all the model can do is estimate how well it will work to the nearest decimal point.

The modellers of this new study don't look at how much their tax on confectionery, biscuits, and cake will cost consumers, but it would clearly run into many millions of pounds and hit people on low incomes the hardest. The researchers brush this off with the usual rhetoric about the health of the poor benefiting the most, despite there being no evidence that this is how sin taxes operate in practice.